The Decline of Business Golf

According to The 8 Rules of Business Golf,

Golf isn’t merely a leisure sport. It’s the martini lunch of the modern workforce, the buoyant venue where work gets done.

That may have been true, but golf—and country club memberships—are in decline. It’s been said that golf is too time-consuming, too slow, too expensive, and too difficult. I think Tom McMakin has identified another reason for the structural diminishment of the sport: it’s become a less effective way to cultivate business relationships over time.

The Propinquity Effect

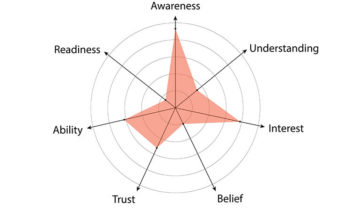

With due respect to Mark Twain, “propinquity” is a useful five-dollar word. It refers to the psychological proximity between people. It can derive from physical closeness, kinship, or other similarities. Propinquity is one of the main factors leading to interpersonal attraction.

As Tom explains, professional services are bought based on relationships and trust. Not surprisingly, the cultivation of propinquity is a key indicator of potential business development success. Frequent interactions over time are the building blocks of relationships—something social psychologists call the mere-exposure effect.

White Shoes and Golfing

White Bucks

A white-shoe firm describes professional services firms in the U.S. that serve large corporations. Historically, the term referred to firms run by WASP elites, particularly those in Boston and New York who attended Ivy League schools, where the white buck dress shoe was a distinctive fashion accessory.

The people in white-shoe firms lived near one another. They attended the same schools, went to the same churches—and played golf at the same country clubs—as their prospective clients. Propinquity abounded. More often than not, the resulting familiarity bred affinity rather than contempt.

As Tom explains:

So maybe our parents were accountants in Poughkeepsie. In order to generate business, in order to create those relationships off of which they’d scope business, they’d meet people at the synagogue or church, or they’d meet people at the golf course. They’d get to know them over a lifetime, and then they would scope business off of those relationships.

However, the emergence of new technologies—and the globalization they have encouraged—are undermining these traditional sources of propinquity, trust, and new business opportunities.

Globalization, Specialization, and Complexity

More than 200 years ago, Adam Smith noted, “The extent of the division of labour…is necessarily regulated…by the extent of the market.” Small towns have general stores, while big cities have boutiques. Small towns have all-purpose CPAs. Global markets have, “very narrowly niched accountant(s) that sells expertise around transfer pricing as it affects sovereign wealth funds.”

- Communication and transportation technologies have extended the scope of the markets we providers of professional services can serve. That’s enabled specialization.

- If you can reach a global market, so can your competition. Our desire to differentiate ourselves encourages specialization.

- The resulting proliferation of diverse and inter-dependent service providers has fueled complexity. In turn, the management of complexity is enhanced by cognitive diversity. That demands specialization.

Niches tend to breed more niches in an expanding market (e.g. heavy metal genres). The more specialized we become, the less likely it becomes that our practice will be supported locally.

The Challenge of Building Long-Distance Relationships

Golfing may be on the decline for a variety of reasons. I suspect that globalization is a primary cause. As the scope of our services narrow, we have to reach farther afield to make a living. The effectiveness of hanging out at the country club as a business development strategy is diminishing.

That’s not to say the importance of relationships, referrals, and trust has diminished. In fact, there is a reason to believe that trust may grow in importance.

Have you ever tried to explain to your child or parent what you actually do for a living? People think they know what accountants do, but few will immediately grasp “transfer pricing” as it relates to “sovereign wealth funds.” As we specialize, our services are increasingly likely to be characterized as credence goods.

In “On Doctors, Mechanics, and Computer Specialists: The Economics of Credence Goods,” economists Uwe Dulleck and Rudolf Kerschbamer observe,

Education and experience give experts the ability to diagnose the exact needs of customers who themselves are only able to detect a need but not the most efficient way to satisfy it. The information problems in markets for diagnosis and treatment suggest that experts may be tempted to defraud customers.

Our specialization creates an advantage. At the same time, it pushes us away from local clients, makes what we do harder to understand, and can increase the threshold level of trust required to engage our services. It’s tough to build trust across distance—even more difficult than playing golf well.